Volvo CE Posts Higher Order Intake, Lower Machine Sales in Q425

Volvo Construction Equipment (Volvo CE) closed 2025 with strong momentum, delivering growth across both machines and services with order intake rising by 18 percent in Q4. The results further demonstrate the company's continued transformation toward becoming a total solutions provider.

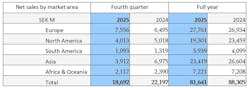

During the fourth quarter the total machine market grew compared to the prior year. Europe, South America, Africa and Oceania, China and North America grew while Asia contracted.

In Q4 2025, net sales decreased by 16 percent to SEK 18,692 M (U.S. $2.46 billion). Adjusted for currency movements and the divestment of SDLG, net sales increased by 12 percent, of which net sales of machines increased by 13 percent and service sales by 8 percent. Both adjusted and reported operating income amounted to SEK 2,599 M (2,609), corresponding to an operating margin of 13.9% (11.8). Compared with Q4 2024, a positive product and market mix and an improved service business were partly offset by lower volumes and increased U.S. tariff costs. Currency movements had a negative impact of SEK 653 M. For the full year 2025, net sales amounted to SEK 81,641 M (88,305). Adjusted operating income amounted to SEK 10,856 M (12,737), corresponding to an adjusted operating margin of 13.3 percent (14.4).

Fourth quarter milestones

In the quarter, Volvo CE maintained strong performance and stability despite uncertain market conditions.

“This has been a positive quarter, driven by increased sales of recently launched products and higher revenue from our services business,” said Melker Jernberg, head of Volvo CE. “Customer response to our new equipment has been strong across key markets, while our solutions offerings continue to gain traction. We enter the new year with solid momentum and a clear focus on driving the industry’s transformation forward.”

In Q4, Volvo CE confirmed Eskilstuna, Sweden, as the location for its new crawler excavator assembly plant serving European markets. The 30,000‑square‑meter facility will strengthen Volvo CE’s position in the key excavator segment by increasing capacity and flexibility to meet growing regional demand.

Volvo CE continued the rollout of its new range of electric models, with the first L120 Electric wheel loaders delivered to customers in selected European and Asian markets.

In December, Volvo CE participated in the EXCON 2025 construction equipment show in India, where the company showcased a portfolio of products and services aimed at supporting the next phase of growth in construction, mining, and material handling.

The European Commission approved of Volvo CE’s acquisition of Swecon.

Market development

The total market in Europe continued to grow in Q4, with support from major markets such as Germany, U.K. and France, on the back of a more positive business outlook in general. The North American market grew slightly in Q4 as the US economy had a development that was better than expectations in the second half of 2025.

Market growth in South America was driven by rebounds in Chile, Argentina and Colombia. The Chinese market continued to grow, though at a slower pace, supported by governmental policies to stimulate the real estate sector and investments in farmland transformation. These mainly drive demand for smaller machines. Asia excluding China registered a modest growth, despite a decline in Japan. There was continued growth in Indonesia, driven by investments in infrastructure and food estate projects and a stable mining industry, as well as growth in Southeast Asia. The markets in Middle East, Australia and Turkey grew, while India was down, mainly for large machines.

About the Author

Michael Roth

Editor

Michael Roth has covered the equipment rental industry full time for RER since 1989 and has served as the magazine’s editor in chief since 1994. He has nearly 30 years experience as a professional journalist. Roth has visited hundreds of rental centers and industry manufacturers, written hundreds of feature stories for RER and thousands of news stories for the magazine and its electronic newsletter RER Reports. Roth has interviewed leading executives for most of the industry’s largest rental companies and manufacturers as well as hundreds of smaller independent companies. He has visited with and reported on rental companies and manufacturers in Europe, Central America and Asia as well as Mexico, Canada and the United States. Roth was co-founder of RER Reports, the industry’s first weekly newsletter, which began as a fax newsletter in 1996, and later became an online newsletter. Roth has spoken at conventions sponsored by the American Rental Association, Associated Equipment Distributors, California Rental Association and other industry events and has spoken before industry groups in several countries. He lives and works in Los Angeles when he’s not traveling to cover industry events.