A Slower First Half in 2024, But No Recession, and Second Half Strength Likely Says PCA Economist Ed Sullivan

Ed Sullivan, Portland Cement Association’s chief economist and senior vice president of market intelligence, predicted that the U.S. economy will gradually weaken during the first half of 2024, but will most likely recover slowly during the second half. Sullivan made that prediction along with others at a press conference at World of Concrete 2024 in Las Vegas. PCA represents cement manufacturers in the United States.

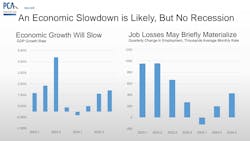

Sullivan explained some of the determining factors for this year’s forecast include the end of the COVID-19 relief programs, the lagged impacts of monetary policy and credit tightening, all are contributing to the slowing. However, Sullivan said a recession is very unlikely in 2024.

“In terms of the construction outlook, there will be a battle between interest-sensitive construction sectors and less interest-sensitive construction activity such as infrastructure spending and the construction of large manufacturing plants associated with the CHIPS Act,” Sullivan said, adding that the CHIPS Act has led to the revitalization of the construction industry.

Also vital to the construction industry this year is business driven by the Infrastructure Investment and Jobs Act (IIJA), which represents $550 billion in new infrastructure spending. Unlike previous funding mechanisms for infrastructure like the American Recovery and Reinvestment Act of 2009, the entire IIJA package is dedicated to revamping infrastructure. Since it was signed into law in 2021, the Biden-Harris Administration says, some 40,000 IIJA projects are underway or have been completed.

Sullivan said onshoring has been a massive investment, adding 80,000 jobs directly. He also pointed out that infrastructure investment in large manufacturing projects are not just the plant, but all the infrastructure surrounding it, including road construction, housing, schools and other types of spending for those employed at the plant.

The scope of funding is broad-based with spending on traditional infrastructure such as roads, bridges, airports, rail, water, and sewer systems. There are also generous spending levels for things like resiliency projects and legacy pollutions, broadband internet, and the energy grid

Sullivan also noted that economic problems in 2024 are not related to unemployment, which is less than 4 percent, but rather on inflation, exacerbated by spikes in oil prices and global political unrest. Sullivan said he expects interest rates to be cut in the second half of 2024 to the degree that inflation is under control. He pointed out that credit tightening poses risks for the construction market.

“The president is right to tout IIJA’s success on the campaign trail — as it was considered an authentically bipartisan bill and has picked up its stride since being launched more than two years ago,” added Mike Ireland, PCA president and CEO. “Our industries hope the Administration, to include the Environmental Protection Agency, will work with cement and concrete manufacturers to determine the most feasible strategies for us to continue to supply the resilient, sustainable construction materials for infrastructure that the country has come to expect.”

About the Author

Michael Roth

Editor

Michael Roth has covered the equipment rental industry full time for RER since 1989 and has served as the magazine’s editor in chief since 1994. He has nearly 30 years experience as a professional journalist. Roth has visited hundreds of rental centers and industry manufacturers, written hundreds of feature stories for RER and thousands of news stories for the magazine and its electronic newsletter RER Reports. Roth has interviewed leading executives for most of the industry’s largest rental companies and manufacturers as well as hundreds of smaller independent companies. He has visited with and reported on rental companies and manufacturers in Europe, Central America and Asia as well as Mexico, Canada and the United States. Roth was co-founder of RER Reports, the industry’s first weekly newsletter, which began as a fax newsletter in 1996, and later became an online newsletter. Roth has spoken at conventions sponsored by the American Rental Association, Associated Equipment Distributors, California Rental Association and other industry events and has spoken before industry groups in several countries. He lives and works in Los Angeles when he’s not traveling to cover industry events.