Infrastructure Spending and Mega Projects Will Continue to Drive Strong Construction, Wells Fargo Report Says

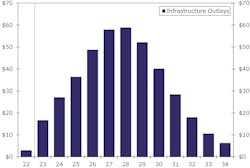

[Chart in billions of dollars]

Over the past three years, the Construction Equipment sector has benefited from a sustained rise in construction activity and a surge in demand for equipment by end users, with the majority of CE dealers facing consistent demand for purchase and rental. According to a quarterly construction report from Wells Fargo Bank, most market data indicators point toward a continuation of steady end user demand for 2024 and into 2025. Infrastructure and mega project spending, mostly the result of recent federal legislation, will be a key driver of equipment demand, the report said. The most noteworthy spending will come from the $1 trillion infrastructure legislation passed in 2021 which will provide a springboard for activity with the bulk of the spending to occur during the next four years.

The Infrastructure Investment and Jobs Act, the Chips and Science Act, and the Inflation Reduction Act are the stimulus programs that should support construction equipment end markets. Eighty percent of the IIJA will go to new funds for roads, bridges, electric power grid; rail, transit and airports; broadband; water, sewer and environmental projects. The Chips Act will provide $250 billion towards American semiconductor sector. Projects must start before December of 2026 to qualify for funding. $39 billion will be for direct funding for U.S. semiconductor manufacturers. Thirteen electric vehicle and battery factories have been announced with an average cost of $3.5 billion.

Nonresidential construction, which was a tailwind for dealers in 2023, is likely to slow down in 2024, the report said, because of higher interest rates, increased construction costs and uncertain demand prospects. Manufacturing spending, driven by the buildout of electric vehicle production supply chains as well as new semiconductor manufacturing facilities, rose 2 percent in January 2024, and is expected to go higher because of support from government spending programs.

The Dodge Momentum Index, a monthly measure of the initial report for nonresidential building projects in planning, which leads construction spending by 12 to 18 months, remains elevated and supports a positive outlook for construction activity.

Rental rates versus new equipment costs

One trend that will be interesting to watch, according to the Wells Fargo report, is the balance between rental rates and the cost of new equipment. Currently, as many dealers and rental companies have aged fleets given the lack of new equipment, rental rates have not increased at the same rate as new equipment coming from OEMs. The combination of strong demand and aged equipment has resulted in dealers achieving a high return on investment in their rental fleets. But there will need to be significant appreciation in rental rates to support higher acquisition costs of new equipment being added to rental fleets.

About the Author

Michael Roth

Editor

Michael Roth has covered the equipment rental industry full time for RER since 1989 and has served as the magazine’s editor in chief since 1994. He has nearly 30 years experience as a professional journalist. Roth has visited hundreds of rental centers and industry manufacturers, written hundreds of feature stories for RER and thousands of news stories for the magazine and its electronic newsletter RER Reports. Roth has interviewed leading executives for most of the industry’s largest rental companies and manufacturers as well as hundreds of smaller independent companies. He has visited with and reported on rental companies and manufacturers in Europe, Central America and Asia as well as Mexico, Canada and the United States. Roth was co-founder of RER Reports, the industry’s first weekly newsletter, which began as a fax newsletter in 1996, and later became an online newsletter. Roth has spoken at conventions sponsored by the American Rental Association, Associated Equipment Distributors, California Rental Association and other industry events and has spoken before industry groups in several countries. He lives and works in Los Angeles when he’s not traveling to cover industry events.