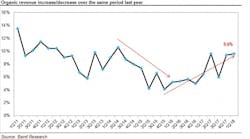

Average rental revenue grew 7 percent year over year in the second quarter compared to the same quarter a year ago, according to the Baird/RER rental survey for the quarter. While a strong number, it fell below the approximately 9.5 percent upticks for the previous two quarters on a year-over-year basis. After declining from 10.6 percent in Q214 to 4.1 percent in Q415, during a period of commodity-related weakness, rental revenue growth has gradually improved though growth remained choppy.

Commentary from respondents noted strength in residential and non-residential construction along with oil and gas improvements. However, for the second consecutive quarter, several participants mentioned peak demand conditions.

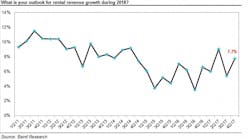

The expectation for growth was less robust than the first-quarter survey. Respondents are expecting revenue to increase 7.4 percent in 2018, a considerably lower expectation than what was forecast after the first quarter.

A couple of selected comments:

- “Demand for rental units used in oil and gas has increased. We are seeing similar increased demand for our equipment used for infrastructure projects.”

- “Nonresidential construction remains steady but likely peaking in 2019. (Local) market starting to slow slightly. All indicators of a late-cycle economy beginning to show as the growth trajectory begins to flatten.

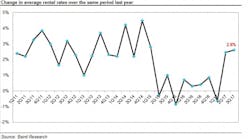

The average rental rate growth was up 1.4 percent year over year, below the 3.8-percent growth last quarter. Smaller sized respondents highlighted increased pricing competition from larger firms more often than in prior surveys. Rate growth expectation also softened. Rental rates are expected to improve 2.1 percent in 2018, down from last quarter’s 4.8-percent expectation.

Numerous respondents commented on supply outweighing demand increasingly. “Increased utilization and demand but some markets and companies have increased fleet to a point that has also strained some of the rates,” said one respondent.

Fleet utilization was greater than 50 percent for the fourth straight quarter but down sequentially at 64.2 percent compared to 65.3 percent last quarter, and up from 53.6 percent in the second quarter of 2017. The utilization rate for access equipment, which accounts for 40 percent of survey revenue, increased to 66.9 percent from 63.9 percent in the second quarter last year, while the utilization rate for earthmoving equipment (31 percent of survey revenue) jumped to 65.9 percent from 57.2 percent in the second quarter of 2017.

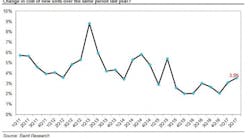

Surprisingly, the cost of new equipment increased less sequentially than in previous quarters, respondents said, with growth in the cost of new units increasing 2.2 percent year over year compared to the previous quarter’s 4.1-percent year-over-year gain and at the low end of the multi-year 2- to 4-percent range.

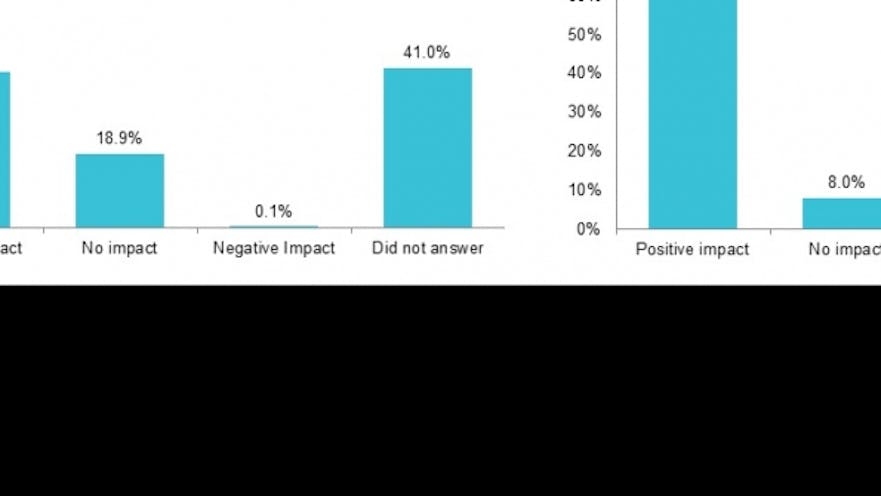

With steel surcharges kicking in as a result of tariffs imposed by the Trump Administration, 61 percent of respondents have altered investment plans. Nineteen percent have accelerated equipment purchases while 42 percent will lower investment. Roughly half reported surcharges are originating primarily from domestic manufacturers with the res seeing surcharges applied more broadly.

Multiple respondents are mentioning lengthening lead times to acquire equipment. “The lead time to get equipment we need is long and causing us to lose rentals due to not having enough equipment,” one respondent said.

Despite initial enthusiasm because of tax reform, 86 percent of respondents reported not increasing fleet spending as a result of tax reform. Only 2 percent of those increasing spending are increasing spending more than 10 percent.