Rental equipment demand was healthy in the second quarter of 2017, with rental revenue growth the highest it’s been in 12 quarters, according to the latest quarterly industry survey by Robert W. Baird & Co. and RER. Utilization was somewhat flat sequentially and a bit down year over year, likely impacted by an unusually rainy spring.

Anecdotal commentary pointed toward continued strong construction demand and improved oil and gas activity.

According to the survey, average rental revenue growth was 9.6 percent year over year in the second quarter compared to the last quarter’s 6.4-percent year over year growth. Average rental rates increased 2.5 percent year over year in Q217, after the previous eight quarter had a range of -1 percent to +1 percent. Average fleet size, in terms of units, grew 6.2 percent in the quarter, the largest gain in 11 years.

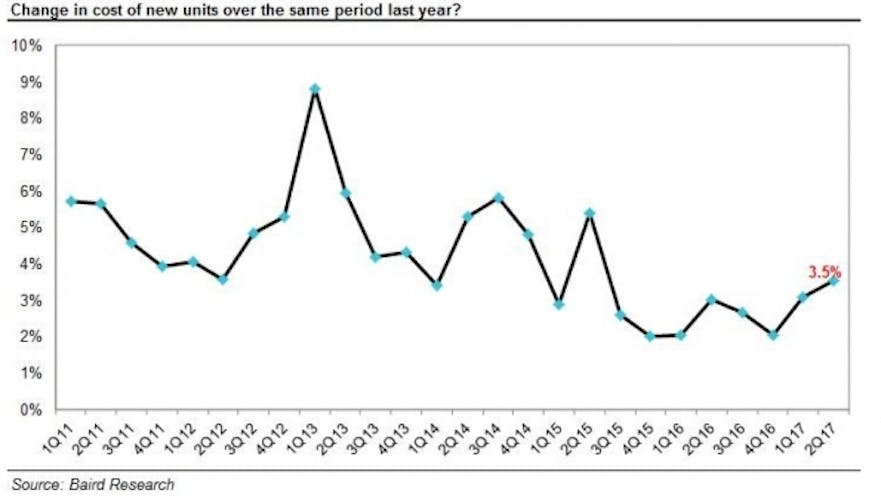

Respondents 2017 growth expectations averaged 9.1 percent compared to expectations of 6 percent after the first quarter. Respondents expect a 6.5 percent increase in fleet purchases in 2017, up from the 5-percent forecast last quarter. Big iron earthmoving equipment expected to increase 10 percent and big iron access 8 percent. Respondents expected to increase 3.8 percent in 2017, the strongest outlook in 11 quarters and an increase from last quarter’s 1.5-percent expectations.

The participants in the Baird-RER survey are senior executives at rental equipment companies or senior managers at regional divisions of rental equipment firms, with 55 percent of participants’ firms generating annual revenue of less than $15 million. Larger companies – greater than $50 million – accounted for 29 percent of respondents and have a disproportionate impact on results.